“The price of anything is the amount of life you exchange for it.”

-Henry David Thoreau

The majority of the people in the great USSA buy into the consumerist mindset; I need to have the next best thing, I need to have the nice car, the insanely large house, the furniture, designer clothes, etc. etc.. Regardless of income, you are trained to buy things. I’m not saying that buying something after you’ve saved for it or because you legitimately need it is wrong, I’m saying the majority of purchases you make, I would be willing to be are made out of impulse, leading you further and further into high interest debt which you pile on credit cards. Before you know it there is no hope of EVER paying it off. At this point you are a slave. But hey, YOLO (You Only Live Once) right?

“The things you own end up owning you…”

Get off the Hamster Wheel

Chances are they got you when you were younger–in college or high school– with a credit card application, or you might have picked up habits from your family and friends. You were a victim of the state of the servile society culture and unfortunately, you can’t go back and change the past– you can’t go back and un-buy all those stupid purchases you made, the $1,000 iPhone 10 you HAD to have because it had a bigger screen and no headphone jack or the $500,000 house with a mortgage you’ll be strapped to for the rest of your life. Trust me, I’ve made my fair share of impulse purchases, don’t beat yourself up because there is hope!

What can you do, today to put yourself on the road to financial freedom; the freedom to go anywhere, travel anywhere you want, and not have to answer to anyone?

The first thing you need to do in order to put yourself on the right path is make the conscious decision to quit buying stupid stuff that you don’t need.

When you go to the store ask yourself, do I really need this? And, more importantly, is this item worth trading a certain amount of my freedom for?

The answer in most cases is no, but you need to change your lifestyle before you are able to work on saving more and paying down the large amount of debts you have accumulated over the years. If you are debt free in America, consider yourself very lucky. A 2015 Pew Research studyfound that 8 out of 10 Americans are in debt.

This is no easy task. The state of the servile society conditions you to believe that debt is good and that a sign of success is flaunting material items as a form of social status. This conditioning has made the majority of the population docile, vulnerable, and easy to control. Because you are too busy being enslaved by financial institutions (who in most cases have formed a holy alliance with government) and working long hours to pay off debts in a never ending cycle, there is no time to think freely and realize that the State has long since chiseled away at your liberties. You need to break out of this cycle no matter how daunting the task, but you have to want to do it.

Make a Budget, and Stick to it!

The quickest way to a successful lifestyle change is to put a debt reduction plan, a budget in place. First off, make the budget realistic, you are not going to be able to save 80% of your income at first, but this is eventually where you will want to be. You are going to want to be eventually saving as much as you can, but before you can do that, come up with a reasonable budget and make small successes. This will increase your self-esteem and give you the confidence to take on bigger challenges. So for example, write down a list of all your expenses from the most expensive to least expensive and then add them up. Is there anything on the list that you can either do away with completely or try to decrease in price? For example, you have a cell phone bill from AT&T for $180 per month. I’m sorry to be a jerk here, but you mean to tell me that you can’t try to use less data, less talk time, etc.? Do you really need 3 dedicated lines or the unlimited data that the teenager salesman at Verizon sold you? Is there a carrier that offers the service for less? Do you even talk on the phone at all or just text? If so, maybe just utilize public Wifi if possible. Feel free to be as creative as possible with this. Once you start knocking down those bills and really saving money, you’ll start to feel better about budgeting in general. Here are a few examples of the largest expenses you might have and what you can do to save some real money:

Cable bills: Direct TV, Dish Network, etc. – Consider unplugging and just getting a Netflix or Amazon Prime membership

Cell phone bills: Dedicated lines, unlimited or large data plans, expensive overpriced phones that were put on a payment plan – Call the carrier or go online and downgrade the plan, pay off phones in full at the outset or just purchase a lower model phone

Car loans: 72 month financing, high APR financing, etc. – The longer you push out the debt with a higher APR, the more money you pay. Consider getting a used car and paying cash for the car, or try and pay off the remaining amount in as little time as possible. Re-finance auto loans with higher APRs (Annual Percentage Rate).

Home Equity Lines / Unsecured Lines of Credit: Probably the worst thing you can do since you are now adding debt upon debt (a second mortgage), so now in addition to making a mortgage payment, you make a payment on a HELOC. Pay this off as soon as possible and CLOSE it!

Credit Cards: The most destructive form of debt since it is so convenient to just throw something on a credit card. Some cards can be an upwards of 15% APR, which means if you made the minimum payments on $10,000 worth of debt, it would take you over 28 years to pay it off.Try this credit card payoff calculator and make a list of all your cards and their APRs.

Student Loan Debt: Most likely it’s lower interest debt, but it is still debt. You’ve accumulated $150,000 of student loans because you decided to go to Harvard or Yale. If you can obtain a job and sell your labor to pay off this debt that’s fine, or you had the foresight to start your own business or develop your own ideas in which case maybe the high priced degree wasn’t worth it in the end? If you want to learn something, go learn it, don’t spend hundreds of thousands wracking up even more debt. Courses can be found online for free. Consider self learning as an alternative to an advanced degree. If you already committed yourself to it and spent the money, try and pay off the debt as soon as you can, but not before you pay off the higher interest credit card debt.

Restaurants / Eating Out: Do you purchase your lunch at a restaurant and go out to dinner more than three times a week? Did you know that you could save a TON of money by either going to the grocery store to shop for food or growing your own food? Not to mention, when you go out to eat you are most likely forcing yourself to eat too much, so it is not good for your health to begin with. Not saying you have to cut out dining in all together, but maybe limit it to once per week or even once per month.

Investing in Yourself

If you have managed to make a budget for yourself and stick to it, congratulations! With the money that you saved on day to day bills and excessive spending, you can now devote these funds to prioritize paying off debt in order from highest APR and then begin saving money little by little. Say you pay off a 15% card with over $10,000 down to $0. What are you going to do with the money you would normally use to make payments? You can easily fall back into the trap of spending this money. Instead, try to think of it in your mind as it already being allocated to yourself, but instead of paying it to bankers, you’re paying yourself. For example, $200 per month was used to pay down debt, take the $200 per month and setup an auto bank draft to automatically draft it a day after you get your paycheck, that way it has already been saved. It feels un-natural at first, but it is the right thing to do, and before you know it you will have accumulated a hefty nest egg.

Once you are pretty far along into your plan for financial self liberation, you’ve paid off the majority of high interest debt, you’ve changed your lifestyle so your spending is very minimal vs. overall income, and you have accumulated a decent amount of money in rainy day funds, it’s time to start thinking about investing and growing this money. You can do this in a number of ways.

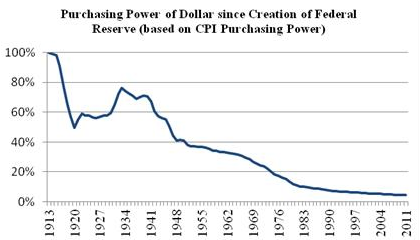

The first way is to invest through traditional financial institutions such as opening a self directed brokerage account and purchasing stocks and bonds in companies. This will allow you to grow money over the long term vs. if it sits in a savings account and the purchasing power of the federal reserve notes you hold erode over time. Read What has the Government Done to Our Money by Murray Rothbard.

Investing in stocks can be risky depending on what you purchase. In most cases, a hand full of large capitalization US stocks should do well over time, or a low cost, low expense Index Exchange Traded Fund (ETF).

But, there are down sides to stock / securities ownership. For one, like everything in the servile society, it is over-regulated and over-taxed. The parasitic class will not let you earn a reasonable return on your own accumulated wealth unless they to can participate in the profits without participating in the risk. The capital gains taxes that you pay when you sell something and from accumulated dividends will add to the ever growing vast amount of funds going towards the support of endless wars, the drug war, needless enforcement of victimless crimes and harassment, extortion, and murder. However, it’s not nearly as much as the funds stolen through the income tax system in place in America. With that being said there are strategies and ways around this. Look into and consider Tax Loss Harvesting.

Gold and Silver

If theres one solid tangible item you can exchange your FERNs for, it’s precious metals such as gold and silver. For thousands of years gold has been used as a store of wealth and value, despite mass bouts of government induced inflation. For example, the highest monthly percentage inflation rate in Zimbabwe in 2008 was 79,600,000,000%.

Extreme examples of hyperinflation like Zimbabwe re-emphasize the need to keep at least a portion of your earnings in precious metals. You can also take a look at the inflation rate in America as well. In many ways, inflation is a de-facto tax on the middle class and poor. The Federal Reserve system allows for the funding of all it’s programs which it deems necessary in every way, including the mass murder overseas and at home. In 2018, the US debt is over $21 Trillion, and current spending in 2018 is over $4 Trillion, that’s over 21% of US GDP.

Looking at the debt numbers in the US translates to less purchasing power of the US dollar. In the future (maybe in the very near future) the USD as a store of value may become unsustainable. People will starting looking at stores of value, as they already have.

Cryptocurrencies

Another great way to store and accumulate value of savings is to hold cryptocurrencies. This is such a vast topic that I’ll only briefly cover some of the main cryptocurrencies and why it would be advantageous to hold. Let’s take a look at the percentage increase in the price of bitcoin in just the last three years:

So, say you had that $1,000 you saved up as a result of paying off most of your debts, if you put in the $1,000 in 2017 you would have had close to $20,000 at Bitcoin’s peak and now over $6,724 at current prices. Some of the alt-coins such as Ethereum, you’d be up multiples of thousands of percent in just a year. You can see how price increases can dramatically help you accumulate savings (and as a result, freedom) easier. What might seem like a never ending up hill battle now seems simple. Some of those that held positions in 2015 are now millionaires.

On another note, crypto can be a savings vehicle, but can also be used as both a method of payment (crypto) and a record system (blockchain). In the long run, you may not even want to convert the crypto back to USD or local currency, since more and more, venders and online merchants are accepting crypto for payment.

In an effort to make this section brief, i’ll say one final thing and that is to use privacy coins such as Monero (XMR), Z-Cash (ZEC), Zen Cash (now Horizen) (ZEN) where possible. This allows for use in anonymity and privacy. Bitcoin and other open blockchain cryptos can be snooped on by governments, or anyone for that matter. If you are using cryptocurrency not only as a store of value but as a method of payment, consider using these alt-coins where possible.

The Road to Freedom

“How much does anybody need? Society tells us we need all this stuff, we need to go buy something new….”

“…I think there is a whole class of people that really want you to consume and spend. The way to deal with rich and predatory people, is to live frugally…”

-Without Bound – Perspectives on Mobile Living

I hope that some of this information has inspired you to make a conscious decision to begin living free. Once you make a budget, stick to it, significantly cut expenses, you can begin extreme saving. And, i’m not talking about 5 or 10%, I’m saying save 80 or 90% of your income, as much as you can. You will begin to slowly see the freedom that accumulated wealth brings. You can go where you want, do what you want, when you want. Unfortunately, in the servile society, there are many challenges such as breaking away from cultural norms, not fitting in with “the mold” and doing what everyone else is doing, getting out of the rat race of working only just to pay bills. You will begin to feel so much better not being a slave to your debtors. It is quite liberating indeed.

Thanks so much for reading. If you took anything away from this article and were able to begin a path to financial freedom, please consider making a voluntary contribution of bitcoin to the following address: